How To Build a Sports Team Budget: 5 Easy-to-Follow Steps

Created by

Vince Ocampo

•

Dec 18, 2025

•

4

min read

How To Build a Sports Team Budget: 5 Easy-to-Follow Steps

Created by

Vince Ocampo

•

Dec 18, 2025

•

4

min read

Budgeting might not be the most exciting part of running a sports team, but it’s one of the most important.

From local youth teams to competitive travel clubs, every team needs a clear financial plan to stay organized, avoid surprise costs, and make the most of every dollar. A well-managed sports team budget helps coaches, parents, and organizers manage expenses, set fair player fees, and keep the season running smoothly from day one.

In this article, you will learn:

How to break down your team’s expenses into must-haves and nice-to-haves

A step-by-step method to build a reliable sports team budget

How TeamLinkt’s new budgeting feature simplifies tracking income and expenses

Let’s kick things off by looking at why budgeting matters more than most teams realize.

Budgeting might not be the most exciting part of running a sports team, but it’s one of the most important.

From local youth teams to competitive travel clubs, every team needs a clear financial plan to stay organized, avoid surprise costs, and make the most of every dollar. A well-managed sports team budget helps coaches, parents, and organizers manage expenses, set fair player fees, and keep the season running smoothly from day one.

In this article, you will learn:

How to break down your team’s expenses into must-haves and nice-to-haves

A step-by-step method to build a reliable sports team budget

How TeamLinkt’s new budgeting feature simplifies tracking income and expenses

Let’s kick things off by looking at why budgeting matters more than most teams realize.

Why a Sports Team Budget is Important

Before you can build a budget, you need to know what you're budgeting for.

Most sports team expenses fall into two main categories: fixed costs and variable costs. Fixed costs are predictable and consistent — things like league registration fees, coaching stipends, or annual insurance. Variable costs can fluctuate based on the season, location, or number of players. Think uniforms, travel, equipment upgrades, or end-of-season celebrations.

Here are some common line items to include in your sports team budget:

Registration fees (league entry, tournament costs)

Uniforms and apparel (jerseys, warm-ups, practice gear)

Equipment (balls, nets, safety gear, maintenance tools)

Field or facility rentals (gyms, fields, practice space)

Referee or official payments

Travel and lodging (if participating in regional or out-of-town games)

Administrative fees (insurance, website costs, payment platforms)

Optional extras (team parties, trophies, coaching clinics)

Separating these costs clearly helps you prioritize essentials and make room for optional extras. Some teams may also categorize expenses by season or by age group, depending on complexity.

The clearer your budget categories, the easier it is to communicate expectations — and avoid mid-season surprises.

Why a Sports Team Budget is Important

Before you can build a budget, you need to know what you're budgeting for.

Most sports team expenses fall into two main categories: fixed costs and variable costs. Fixed costs are predictable and consistent — things like league registration fees, coaching stipends, or annual insurance. Variable costs can fluctuate based on the season, location, or number of players. Think uniforms, travel, equipment upgrades, or end-of-season celebrations.

Here are some common line items to include in your sports team budget:

Registration fees (league entry, tournament costs)

Uniforms and apparel (jerseys, warm-ups, practice gear)

Equipment (balls, nets, safety gear, maintenance tools)

Field or facility rentals (gyms, fields, practice space)

Referee or official payments

Travel and lodging (if participating in regional or out-of-town games)

Administrative fees (insurance, website costs, payment platforms)

Optional extras (team parties, trophies, coaching clinics)

Separating these costs clearly helps you prioritize essentials and make room for optional extras. Some teams may also categorize expenses by season or by age group, depending on complexity.

The clearer your budget categories, the easier it is to communicate expectations — and avoid mid-season surprises.

How to Build a Sports Team Budget Step-by-Step

Once you’ve identified your team’s expected expenses and income sources, it’s time to turn those numbers into a working plan. A sports team budget doesn’t have to be complicated, but it does have to be clear, consistent, and revisited regularly. These five steps will help you build a budget that keeps your season on track and your stakeholders in the loop.

Step 1: List All Expected Income Sources

Begin by outlining every potential source of revenue for your team. For most amateur and youth sports teams, this includes:

Player registration or participation fees

Team or league sponsorships from local businesses or community organizations

Fundraising events like car washes, bake sales, or silent auctions

Team merchandise sales (hoodies, hats, fan gear)

Community donations or grants from sports foundations or civic groups

Youth sports can be a significant financial commitment for many families. According to an Aspen Institute survey of parents, U.S. families spent an average of about $1,016 per child on their primary sport in 2024, with total expenses nearing $1,500 when accounting for multiple teams or programs for a single child, which highlights why fundraising and careful budgeting are essential parts of managing team finances.

Step 2: Estimate All Known and Potential Expenses

Now it’s time to itemize your costs, both essential and optional. This includes:

Fixed costs: league registration, insurance, coach stipends, admin fees

Variable costs: uniforms, equipment, travel, tournament fees, refs

Extras: trophies, team bonding events, optional clinics or camps

Be as detailed as possible. Include one-off seasonal costs as well as recurring monthly expenses. Using last year’s budget (if available) can help avoid common underestimations like forgetting how much travel fuel or team snacks really cost.

If you're working with a league or school, check if they already have a budget template or standard cost ranges for common line items. Resources like TeamLinkt’s budgeting guide can also help.

Step 3: Set a Per-Player Cost or Fundraising Goal

Once you know your total projected expenses, divide that amount by the number of players on the team. This gives you a per-player baseline cost. Depending on your financial model, this number becomes either:

The registration fee per player, or

The minimum fundraising target for each family

Being transparent about this figure early on avoids confusion and sets clear expectations. If some families need support, consider offering flexible payment plans or allowing them to offset fees by volunteering at events.

Step 4: Add a Buffer for Unexpected Costs

Even the best‑laid budgets encounter surprises: weather delays, extra playoff games, or emergency equipment replacements. To protect your finances, add a buffer, typically 5–10% of the total budget, for these kinds of situations. This contingency fund helps teams cope without scrambling mid‑season.

If you don’t use the buffer by season’s end, you can roll it into next year’s budget, donate it to a local cause, or use it for a team celebration.

Step 5: Review and Adjust Monthly or Quarterly

A sports team budget isn’t a “set it and forget it” document. Schedule regular check-ins, monthly or quarterly, to compare your projected vs actual income and expenses. This gives you a chance to correct course early if spending is off track or if fundraising falls short.

Sharing budget updates with your coaching staff, board members, or parent group fosters trust and encourages shared responsibility. Tools like Google Sheets, QuickBooks, or sports-specific platforms like TeamLinkt (more on that soon) can make ongoing reviews much easier.

How to Build a Sports Team Budget Step-by-Step

Once you’ve identified your team’s expected expenses and income sources, it’s time to turn those numbers into a working plan. A sports team budget doesn’t have to be complicated, but it does have to be clear, consistent, and revisited regularly. These five steps will help you build a budget that keeps your season on track and your stakeholders in the loop.

Step 1: List All Expected Income Sources

Begin by outlining every potential source of revenue for your team. For most amateur and youth sports teams, this includes:

Player registration or participation fees

Team or league sponsorships from local businesses or community organizations

Fundraising events like car washes, bake sales, or silent auctions

Team merchandise sales (hoodies, hats, fan gear)

Community donations or grants from sports foundations or civic groups

Youth sports can be a significant financial commitment for many families. According to an Aspen Institute survey of parents, U.S. families spent an average of about $1,016 per child on their primary sport in 2024, with total expenses nearing $1,500 when accounting for multiple teams or programs for a single child, which highlights why fundraising and careful budgeting are essential parts of managing team finances.

Step 2: Estimate All Known and Potential Expenses

Now it’s time to itemize your costs, both essential and optional. This includes:

Fixed costs: league registration, insurance, coach stipends, admin fees

Variable costs: uniforms, equipment, travel, tournament fees, refs

Extras: trophies, team bonding events, optional clinics or camps

Be as detailed as possible. Include one-off seasonal costs as well as recurring monthly expenses. Using last year’s budget (if available) can help avoid common underestimations like forgetting how much travel fuel or team snacks really cost.

If you're working with a league or school, check if they already have a budget template or standard cost ranges for common line items. Resources like TeamLinkt’s budgeting guide can also help.

Step 3: Set a Per-Player Cost or Fundraising Goal

Once you know your total projected expenses, divide that amount by the number of players on the team. This gives you a per-player baseline cost. Depending on your financial model, this number becomes either:

The registration fee per player, or

The minimum fundraising target for each family

Being transparent about this figure early on avoids confusion and sets clear expectations. If some families need support, consider offering flexible payment plans or allowing them to offset fees by volunteering at events.

Step 4: Add a Buffer for Unexpected Costs

Even the best‑laid budgets encounter surprises: weather delays, extra playoff games, or emergency equipment replacements. To protect your finances, add a buffer, typically 5–10% of the total budget, for these kinds of situations. This contingency fund helps teams cope without scrambling mid‑season.

If you don’t use the buffer by season’s end, you can roll it into next year’s budget, donate it to a local cause, or use it for a team celebration.

Step 5: Review and Adjust Monthly or Quarterly

A sports team budget isn’t a “set it and forget it” document. Schedule regular check-ins, monthly or quarterly, to compare your projected vs actual income and expenses. This gives you a chance to correct course early if spending is off track or if fundraising falls short.

Sharing budget updates with your coaching staff, board members, or parent group fosters trust and encourages shared responsibility. Tools like Google Sheets, QuickBooks, or sports-specific platforms like TeamLinkt (more on that soon) can make ongoing reviews much easier.

Tools That Make Sports Team Budgeting Easier

You don’t need to be an accountant to manage your sports team’s budget, but the right tools can make it feel like you are. Whether you're running a small local soccer team or coordinating travel baseball across states, having the right platform for budgeting can save time, reduce errors, and improve communication.

Here are some of the most helpful tools for creating and managing your sports team budget:

Google Sheets or Microsoft Excel

For teams that want total control and flexibility, spreadsheets are a go-to solution. They’re free, customizable, and easy to share. You can build formulas to track player payments, calculate totals automatically, and update numbers in real time. The downside: spreadsheets require manual setup and are more prone to human error if you’re not careful.

Accounting Software (QuickBooks, Wave)

If your team operates like a small business — especially at the travel or elite level — tools like QuickBooks or Wave offer professional-level accounting support. You can generate reports, track income and expenses, sync with bank accounts, and prepare for tax time if needed. These tools do have a learning curve, but they’re powerful for teams with larger budgets and multiple income streams.

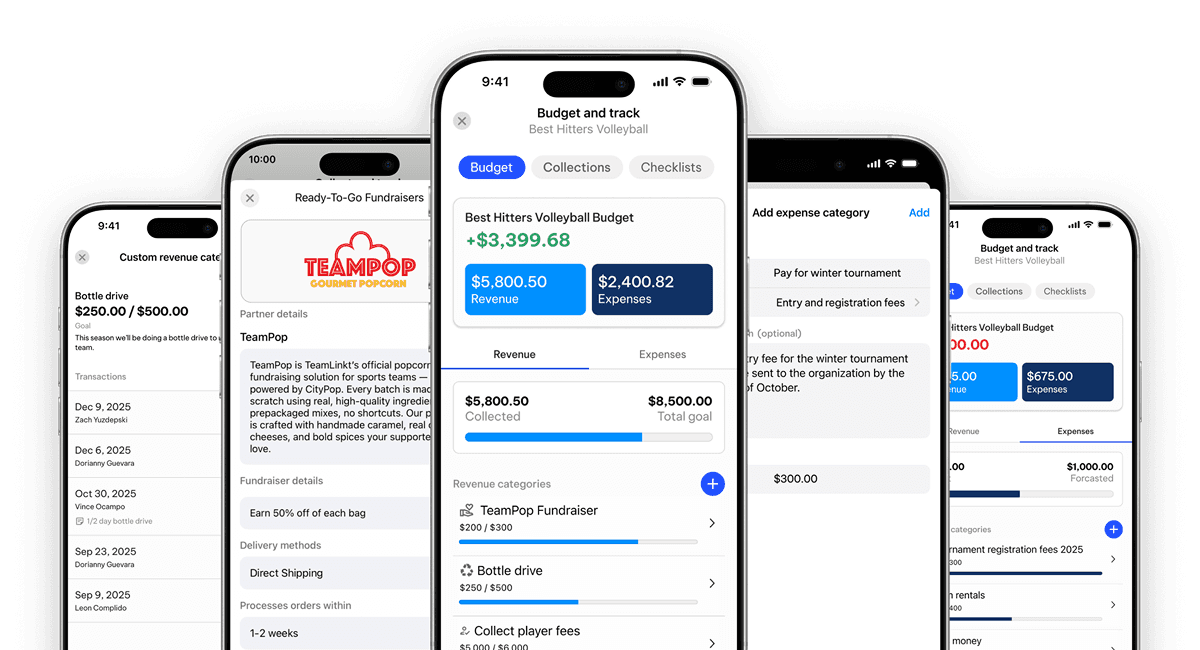

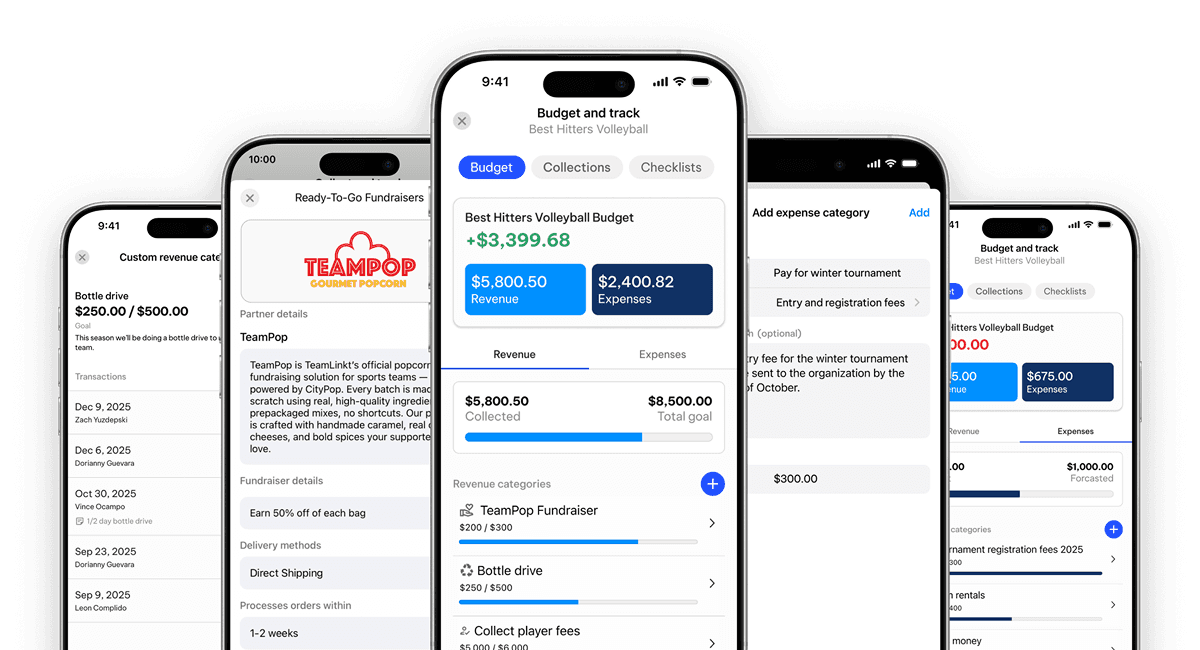

Sports-Specific Tools Like TeamLinkt

TeamLinkt offers an all-in-one platform designed specifically for sports teams and leagues, and a new built-in budgeting feature that makes financial management more seamless than ever. With integrated income and expense tracking, team organizers can:

Track payments, sponsorships, and fundraising revenue in one place

Log expenses as they occur and categorize them clearly

Share real-time financial updates with coaches or parents

Avoid spreadsheet errors and manual math mistakes

This kind of purpose-built tool reduces friction, saves time, and helps small teams operate more like well-run organizations without needing a finance degree.

Tools That Make Sports Team Budgeting Easier

You don’t need to be an accountant to manage your sports team’s budget, but the right tools can make it feel like you are. Whether you're running a small local soccer team or coordinating travel baseball across states, having the right platform for budgeting can save time, reduce errors, and improve communication.

Here are some of the most helpful tools for creating and managing your sports team budget:

Google Sheets or Microsoft Excel

For teams that want total control and flexibility, spreadsheets are a go-to solution. They’re free, customizable, and easy to share. You can build formulas to track player payments, calculate totals automatically, and update numbers in real time. The downside: spreadsheets require manual setup and are more prone to human error if you’re not careful.

Accounting Software (QuickBooks, Wave)

If your team operates like a small business — especially at the travel or elite level — tools like QuickBooks or Wave offer professional-level accounting support. You can generate reports, track income and expenses, sync with bank accounts, and prepare for tax time if needed. These tools do have a learning curve, but they’re powerful for teams with larger budgets and multiple income streams.

Sports-Specific Tools Like TeamLinkt

TeamLinkt offers an all-in-one platform designed specifically for sports teams and leagues, and a new built-in budgeting feature that makes financial management more seamless than ever. With integrated income and expense tracking, team organizers can:

Track payments, sponsorships, and fundraising revenue in one place

Log expenses as they occur and categorize them clearly

Share real-time financial updates with coaches or parents

Avoid spreadsheet errors and manual math mistakes

This kind of purpose-built tool reduces friction, saves time, and helps small teams operate more like well-run organizations without needing a finance degree.

Sports Budgeting Best Practices for Coaches, Parents & Admins

Even with great tools and a clear plan, your sports team budget is only as effective as the people managing it. Whether you're a head coach, team manager, league organizer, or parent volunteer, sticking to a few fundamental budgeting principles can prevent overspending, reduce confusion, and create a stronger sense of accountability across your team.

Below are some of the most effective best practices to follow:

1. Keep It Simple But Detailed

A sports team budget should be easy to understand, but also specific enough to guide decisions. Break down broad categories like “equipment” into detailed line items. For example, list cones, practice balls, goalie gloves, and replacement nets separately. This not only improves accuracy but also helps justify costs when sharing with parents or sponsors.

When budgets are overly vague, it becomes harder to identify where the money actually goes, and that’s when issues arise.

2. Share the Budget with Stakeholders

Transparency builds trust. Give assistant coaches, parent committees, and board members access to the budget early in the season, even if it's just view-only. Doing this eliminates surprises, reduces the potential for confusion or conflict, and helps families feel confident in how their contributions are being spent.

A transparent budget also makes fundraising easier. People are far more likely to support a team financially when they know exactly where the money is going.

3. Document Everything

Every receipt, invoice, or donation letter matters, especially if you're working with a booster club, school, or nonprofit league that requires financial reporting. Use cloud storage like Google Drive, Dropbox, or budgeting platforms with file attachment features to stay organized and compliant.

It also makes tax season (if applicable) and year-end wrap-ups much easier for whoever picks up the budget next year.

4. Use Last Year’s Budget as a Baseline

If you’re not starting from scratch, last year’s budget is one of your most powerful tools. Review it carefully and look for lessons: Where did you overspend? Were there unexpected costs? Did you collect less from fundraising than you projected?

Adjust this year’s numbers based on what actually happened, not just what you hoped would happen. This kind of year-over-year improvement builds financial resilience and helps your program grow sustainably.

5. Track and Review as You Go

It’s tempting to “set it and forget it,” especially once the season kicks off. But financial tracking isn’t a one-time task; it’s an ongoing process. Set a recurring calendar reminder to check in monthly or after key events like fundraisers or tournaments.

Teams that monitor their budget throughout the season are more likely to stay on target and less likely to face financial stress in the final weeks.

These best practices aren’t just about keeping a clean spreadsheet; they’re about fostering a culture of communication, responsibility, and shared ownership. When everyone understands the financial picture, the team functions more smoothly, on and off the field.

Sports Budgeting Best Practices for Coaches, Parents & Admins

Even with great tools and a clear plan, your sports team budget is only as effective as the people managing it. Whether you're a head coach, team manager, league organizer, or parent volunteer, sticking to a few fundamental budgeting principles can prevent overspending, reduce confusion, and create a stronger sense of accountability across your team.

Below are some of the most effective best practices to follow:

1. Keep It Simple But Detailed

A sports team budget should be easy to understand, but also specific enough to guide decisions. Break down broad categories like “equipment” into detailed line items. For example, list cones, practice balls, goalie gloves, and replacement nets separately. This not only improves accuracy but also helps justify costs when sharing with parents or sponsors.

When budgets are overly vague, it becomes harder to identify where the money actually goes, and that’s when issues arise.

2. Share the Budget with Stakeholders

Transparency builds trust. Give assistant coaches, parent committees, and board members access to the budget early in the season, even if it's just view-only. Doing this eliminates surprises, reduces the potential for confusion or conflict, and helps families feel confident in how their contributions are being spent.

A transparent budget also makes fundraising easier. People are far more likely to support a team financially when they know exactly where the money is going.

3. Document Everything

Every receipt, invoice, or donation letter matters, especially if you're working with a booster club, school, or nonprofit league that requires financial reporting. Use cloud storage like Google Drive, Dropbox, or budgeting platforms with file attachment features to stay organized and compliant.

It also makes tax season (if applicable) and year-end wrap-ups much easier for whoever picks up the budget next year.

4. Use Last Year’s Budget as a Baseline

If you’re not starting from scratch, last year’s budget is one of your most powerful tools. Review it carefully and look for lessons: Where did you overspend? Were there unexpected costs? Did you collect less from fundraising than you projected?

Adjust this year’s numbers based on what actually happened, not just what you hoped would happen. This kind of year-over-year improvement builds financial resilience and helps your program grow sustainably.

5. Track and Review as You Go

It’s tempting to “set it and forget it,” especially once the season kicks off. But financial tracking isn’t a one-time task; it’s an ongoing process. Set a recurring calendar reminder to check in monthly or after key events like fundraisers or tournaments.

Teams that monitor their budget throughout the season are more likely to stay on target and less likely to face financial stress in the final weeks.

These best practices aren’t just about keeping a clean spreadsheet; they’re about fostering a culture of communication, responsibility, and shared ownership. When everyone understands the financial picture, the team functions more smoothly, on and off the field.

Smarter Sports Budgeting for Modern Teams Using TeamLinkt's Budget Tool

While traditional spreadsheets can serve basic budgeting needs, many teams outgrow their limitations. As finances become more complex and as more people need access or visibility, managing a budget with disconnected tools can lead to errors, confusion, and missed payments.

That’s where TeamLinkt’s sports team budgeting feature stands out.

TeamLinkt’s budgeting feature offers a purpose-built solution designed specifically for modern sports organizations. With TeamLinkt, coaches, team managers, and league organizers gain access to a powerful financial dashboard that centralizes every element of sports team budgeting from income tracking to detailed expense management.

Here are some of the key advantages of using TeamLinkt’s budgeting tool:

Tracks income and expenses in real time, including payments, sponsorships, and fundraising

Assigns categories to transactions for clear reporting and easy analysis

Generates professional budget summaries that can be shared with parents, coaches, or administrators

Stores receipts and documentation securely alongside transactions for full transparency

Instead of juggling spreadsheets, payment platforms, and group chats, TeamLinkt brings everything into one place reducing manual work and ensuring everyone stays informed.

For modern teams looking to simplify their budgeting process and improve financial clarity, TeamLinkt offers a solution tailored specifically to the needs of sports organizations.

Smarter Sports Budgeting for Modern Teams Using TeamLinkt's Budget Tool

While traditional spreadsheets can serve basic budgeting needs, many teams outgrow their limitations. As finances become more complex and as more people need access or visibility, managing a budget with disconnected tools can lead to errors, confusion, and missed payments.

That’s where TeamLinkt’s sports team budgeting feature stands out.

TeamLinkt’s budgeting feature offers a purpose-built solution designed specifically for modern sports organizations. With TeamLinkt, coaches, team managers, and league organizers gain access to a powerful financial dashboard that centralizes every element of sports team budgeting from income tracking to detailed expense management.

Here are some of the key advantages of using TeamLinkt’s budgeting tool:

Tracks income and expenses in real time, including payments, sponsorships, and fundraising

Assigns categories to transactions for clear reporting and easy analysis

Generates professional budget summaries that can be shared with parents, coaches, or administrators

Stores receipts and documentation securely alongside transactions for full transparency

Instead of juggling spreadsheets, payment platforms, and group chats, TeamLinkt brings everything into one place reducing manual work and ensuring everyone stays informed.

For modern teams looking to simplify their budgeting process and improve financial clarity, TeamLinkt offers a solution tailored specifically to the needs of sports organizations.

Get Started With TeamLinkt Today

Switch to TeamLinkt for free, and transform the way you manage sports.

Get Started With TeamLinkt Today

Switch to TeamLinkt for free, and transform the way you manage sports.

Programs

Platform

All rights reserved by TeamLinkt / QuickLinkt Solutions Inc.

Copyright © 2026

All rights reserved by TeamLinkt / QuickLinkt Solutions Inc. Copyright © 2026

All rights reserved by TeamLinkt / QuickLinkt Solutions Inc. Copyright © 2026